Delivering Brand Impact at the Source — Devices, Screens & Premium Media

Building on our OEM Advertising foundation, Carbondyne has evolved into a global programmatic marketplace that connects brands and agencies to high-quality media across mobile devices, Connected TV, and curated Private Marketplace (PMP) inventory.

We work across the supply side of the programmatic ecosystem to ensure campaigns run in brand-safe, high-visibility, and performance-optimized environments, particularly across emerging and growth markets.

This evolution complements our original OEM focus on device-level access and extends it to larger, full-funnel programmatic strategies

What We Do

Through OEM-level integrations, Carbondyne enables businesses to:

Provide programmatic infrastructure

that enables access, curation, and execution across OEM environments, Connected TV (CTV), and private marketplaces.

Curate and manage Private Marketplace (PMP) deals

including inventory selection, deal structuring, packaging, and ongoing supply-side optimization.

Enable DSP-agnostic activation

supporting agencies with existing DSPs as well as those requiring managed DSP access and execution support.

Deliver premium OEM advertising access

across device-level environments such as app stores, content feeds, system apps, and discovery surfaces.

Support high-impact CTV campaigns

offering access to premium streaming and smart-TV environments for brand-safe, full-screen video delivery.

Operate a supply-side optimization layer

bridging DSP performance signals with publisher and inventory-level insights to improve campaign outcomes.

Simplify programmatic execution in fragmented markets

reducing operational complexity while maintaining transparency and control.

Improve agency economics

enabling flexible commercial models, bundled offerings, and enhanced margins through infrastructure-led execution.

Where brands meet users before apps, browsers, and algorithms compete for attention.

OEM Advertising

OEM advertising (Original Equipment Manufacturer advertising) is a form of digital advertising delivered directly through devices at the operating-system and firmware level, such as smartphones, feature phones, smart TVs, and connected devices. Unlike traditional app or web ads, OEM advertising reaches users via native placements including device notifications, app folders, system apps, lock screens, recommendation feeds, and pre-installed app inventory, allowing brands to engage audiences from the moment a device is activated. This channel offers high visibility, brand safety, and precise targeting based on device type, geography, usage signals, and carrier data, making it especially effective for app installs, brand awareness, financial services, and performance-driven campaigns at scale.

Why OEM Advertising?

- Unmatched Visibility: Your brand appears directly on the device interface.

- Higher Engagement: Capture attention during natural user interactions.

- Lower Acquisition Cost: Reduce reliance on traditional digital ad bidding.

- Regional Penetration: Tap into markets where app store access may be limited.

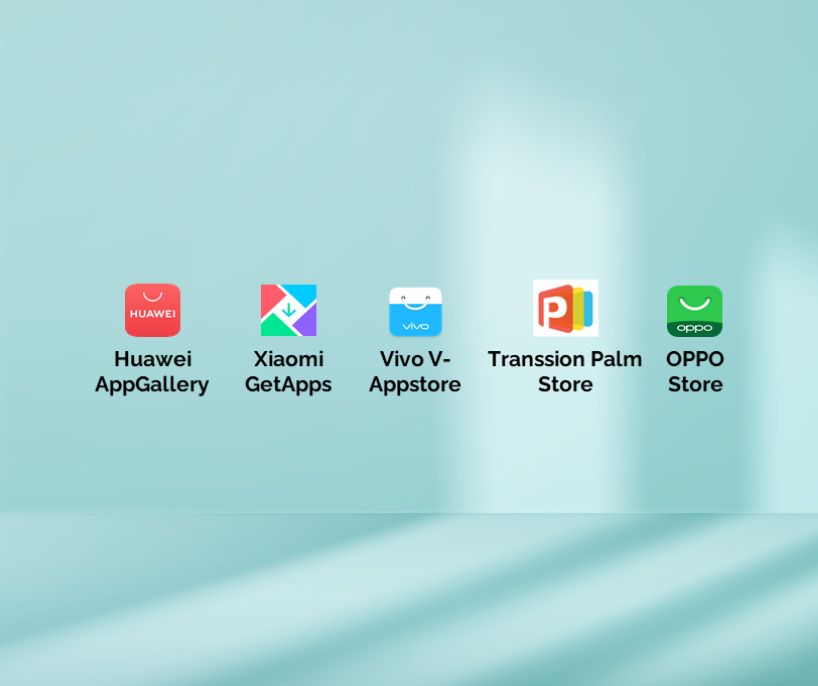

Our OEM Network

Carbondyne collaborates with top-tier OEMs including Apple, Samsung, Xiaomi, Huawei, Realme, Onelus, Vivo, Oppo, Transsion Holdings (Tecno, Itel, Infinix) and other Android-based manufacturers in South Asia and Africa. This allows us to deliver precise market penetration with device-level campaign intelligence.

Global Market shares by brands

* Transsion includes itel, Infinix and TELCO

4 Types Of Product Offerings

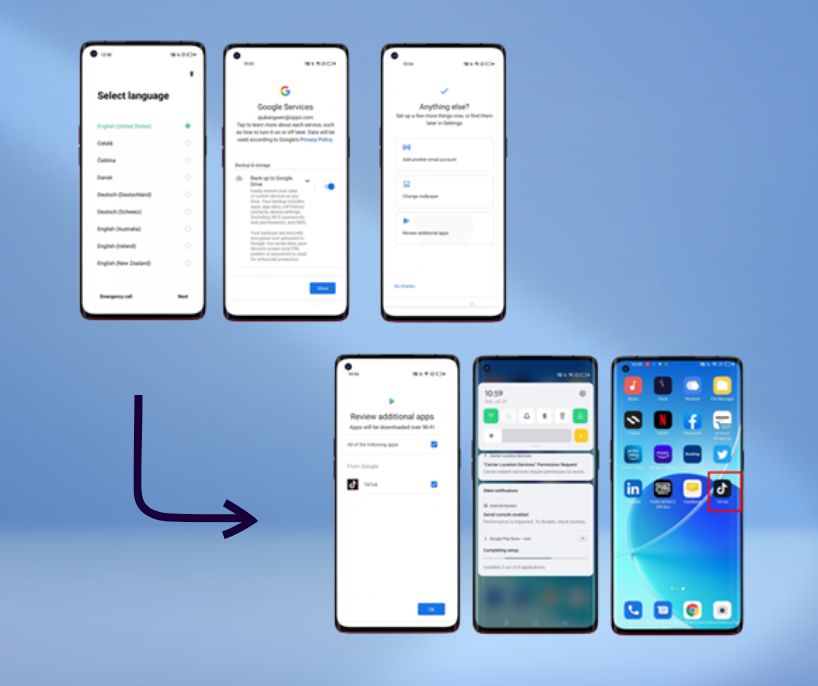

Dynamic Preloads

(Play Auto Install)

Introduce app to users when they’re unboxing their new devices

- Be #1 App in the category

- Build brand visibility

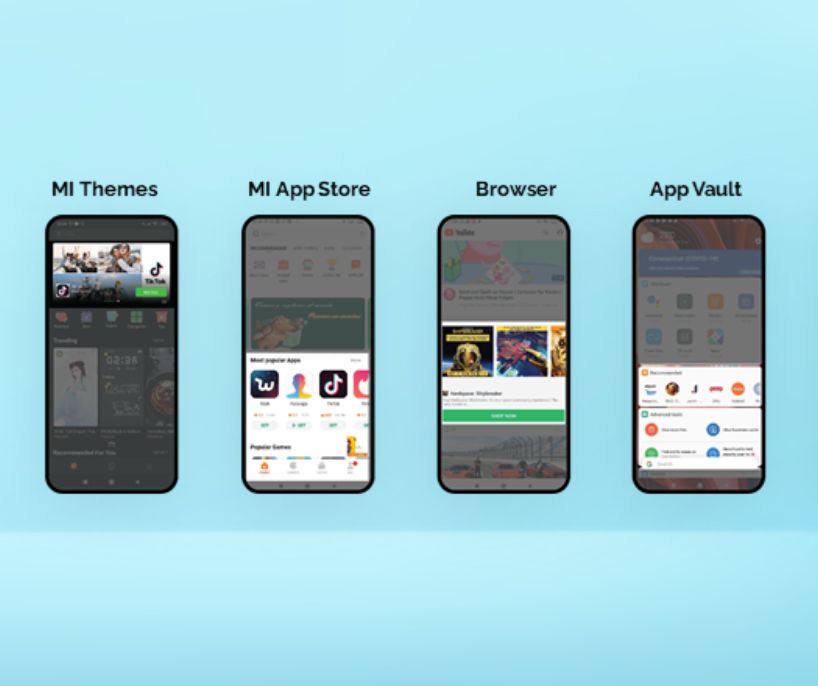

Display Ads

Display Ads about app directly on end users’ devices, based on users’ app usage on the device (if they already install and are actively using other similar apps)

- Acquire new users & retarget current users

- Optimize in-app event conversion rate, RR & ROAS

Alternative App Stores

Get your app onto each OEM’s app store and increase your app’s visibility and opportunity to advertise within that OEM ecosystem

- Get your app featured on the OEM app store

- Freedom of choice with alternative payment solutions

- Negotiate with OEMs to get a larger cut of each sale or IAP

Branding

Grab users attention and gain brand recognition and mindshare through the various advertising methods mobile OEMs offer

- Build genuine connection with users through understanding user intent

- Myriad of targeting options to pinpoint the brands’ target audience

- Leverage a variety of advertising options to always stay top of mind

Extending Impact Beyond Mobile

Connected TV (CTV)

As audiences increasingly consume content on large screens, Carbondyne enables access to Connected TV (CTV) inventory across premium streaming and smart-TV environments.

CTV Capabilities

- Full-screen, non-skippable video formats

- Household-level targeting

- High attention and completion rates

- Brand-safe, premium content environments

CTV is particularly effective for brand lift, trust-led messaging, and upper-funnel campaigns across BFSI, telecom, FMCG, and consumer services, and complements OEM and mobile-led performance strategies.

CTV ads out of total TV ads globally

CTV ads out of total digital video ad spend

Ad-supported streaming out of total TV viewing time

Connected TV (CTV) Ad Spend Growth by Region – 2025

Connected TV adoption is accelerating globally, with the strongest growth coming from emerging and mobile-first markets. While North America and Europe continue to scale steadily, APAC, Latin America, and the Middle East & Africa are seeing significantly higher year-on-year growth as streaming penetration, smart TV adoption, and programmatic CTV buying expand.

Market Adoption & Agency Trends

- A significant portion of advertisers see CTV as a core channel: a majority of marketers plan to increase CTV spend in the second half of 2025, often outpacing increases in other digital channels.

- In APAC and emerging markets, CTV is growing rapidly, with forecasts in some markets (like India and Australia) showing above-average growth rates as consumer viewing shifts from linear TV to streaming.

CTV Ad Spend Growth

- Global CTV ad spending is forecast to reach ~$33.35 billion in 2025, representing strong double-digit growth and highlighting the shift from traditional TV to streaming-based advertising. Future Market Insights

- CTV ad spending is growing much faster than linear TV, with digital video (including CTV) expected to capture nearly 60 % of total TV/video ad spend in 2025, driven by streaming and programmatic expansion.

- Some industry projections even estimate global CTV ad spend approaching ~$48 billion in 2025 — up roughly 33 % from 2023 levels.

Audience Behavior & Viewing Trends

- Ad-supported streaming content is increasingly dominant: in early 2025, ad-supported formats accounted for around 73 % of total time spent watching TV, showing how audiences are embracing monetized streaming.

📌 Key Takeaways

✅ CTV is no longer niche — it is a central part of digital video and programmatic media plans in 2025.

✅ Ad spend is shifting at scale — billions of dollars are moving away from traditional TV toward CTV, especially in the U.S. and APAC markets.

✅ Marketers are increasing CTV budgets because of strong performance, audience reach, and targeting capabilities that rival digital channels.

Source: Aggregated industry forecasts from GroupM, eMarketer, IAB, Magna Global (2024–2025). Figures shown are indicative.

Simplifying Programmatic Buying Through Supply-Side Curation

Private Marketplace (PMP) Infrastructure

Programmatic advertising has become increasingly complex, fragmented across exchanges, formats, and inventory quality tiers. Carbondyne addresses this complexity by operating a curated Private Marketplace (PMP) infrastructure layer that sits on the supply side of the programmatic ecosystem.

Rather than relying solely on open auction dynamics, our PMP framework enables agencies and brands to access hand-selected, continuously optimized inventory designed to deliver stronger performance, improved transparency, and reduced operational overhead.

What Makes Carbondyne’s PMP Approach Different

Traditional PMP workflows require extensive manual negotiation, quality assurance, and ongoing optimization between DSPs, SSPs, and publishers. Carbondyne removes this friction by centralizing curation, optimization, and deal management on the supply side.

Key principles include:

- Inventory is curated, not aggregated

- Optimization happens continuously on the supply side

- Performance is improved without adding cost or operational burden

- Agencies retain full control within their existing DSP workflows

Human-Led Supply-Side Optimization

While DSP algorithms optimize bidding and targeting, they often lack visibility into publisher-level performance drivers and contextual nuances. Carbondyne introduces human-led supply-side trading, where curated inventory is actively optimized using insights from DSP performance data.

This bridges the traditional gap between DSP objectives and SSP execution, allowing:

- Faster performance improvements

- Reduced wastage on underperforming placements

- More predictable delivery against KPIs

PMP Libraries & Inventory Curation

Carbondyne enables access to multiple curated PMP libraries, allowing agencies to activate deals quickly or request custom configurations.

Available PMP categories include:

- Contextual PMPs aligned to content relevance

- Audience-layered PMPs using publisher first-party and third-party data

- Performance-driven PMPs optimized for KPIs such as CTR, VCR, CPA, or ROI

- Domain-scored PMPs prioritizing publishers that over-index on target demographics

- Sensitive category PMPs for regulated verticals such as BFSI, pharma, telecom, political, and crypto

- CTV and DOOH PMPs for premium, high-impact environments

DSP-Agnostic Activation

Carbondyne’s PMP infrastructure is designed to work across major DSPs, allowing agencies to activate curated deals without onboarding new platforms or retraining teams.

- No demand-side contracts required

- No minimum spend commitments

- No changes to existing campaign setup

- Full compatibility with standard DSP controls such as brand safety, blocklists, frequency caps, and audience suppression

Reporting, Transparency & Deal Health

Carbondyne provides visibility into deal health and supply performance, enabling agencies to monitor and refine PMP execution efficiently.

Reporting covers:

- Bid rate and win rate

- Bid blocking and supply availability

- Publisher and placement-level performance

- Channel, format, OS, and environment insights

Live PMPs can be refined quickly by excluding underperforming publishers, domains, apps, or bundle IDs directly from reporting insights

Designed for Scale — Across Formats and Markets

Carbondyne’s PMP infrastructure supports scale across:

- Display

- Video

- Native

- Audio

- Connected TV (CTV)

This allows agencies to deploy consistent, curated strategies across geographies, formats, and screens without duplicating effort

Why Agencies Use PMP Infrastructure

Agencies leverage Carbondyne’s PMP layer to:

- Reduce time spent negotiating and managing individual PMPs

- Improve performance versus open auction buying

- Maintain brand safety and contextual alignment

- Access premium inventory without operational complexity

Preserve DSP flexibility and existing workflows

Commercial Advantage for Agencies

Carbondyne is structured to improve both performance and agency economics.

- No minimum spend commitments

- Faster access to premium inventory

- Ability to productize OEM, PMP, and CTV offerings

- Additional 10% to 20% rebate provided by Carbondyne on campaign spend executed through us

- This applies on top of any rebates already offered by DSPs, including DV360

- Improved margins and pricing flexibility

Enabling Programmatic Buying With or Without a DSP

DSP Access & Execution Infrastructure

Carbondyne provides flexible DSP access and execution infrastructure designed to support agencies and brands at different stages of programmatic maturity. Whether an agency already operates its own DSP or does not have direct DSP access, Carbondyne ensures seamless participation in premium programmatic buying across OEM, CTV, and curated Private Marketplace (PMP) inventory.

Our role is not to replace agency planning or strategy, but to remove operational and contractual barriers that often limit access to high-quality programmatic supply.

For Agencies With Existing DSP Access

Agencies already operating DSPs can activate curated PMP and CTV deals directly within their existing platforms.

- PMP Deal IDs are provisioned for activation inside the agency’s DSP

- No changes to existing campaign workflows

- Full control over targeting, bidding, pacing, and optimization

- Continued use of existing brand safety tools, blocklists, and measurement partners

Carbondyne operates on the supply and infrastructure layer, ensuring inventory quality, deal health, and performance optimization without interfering with demand-side execution.

For Agencies Without a DSP

For agencies that do not operate a DSP, Carbondyne provides managed DSP access and execution support.

This enables agencies to:

- Launch programmatic campaigns without signing DSP contracts

- Access premium OEM, CTV, and curated PMP inventory

- Participate in programmatic buying without technical or compliance overhead

- Receive transparent reporting and performance insights

Managed DSP access allows agencies to focus on client servicing, planning, and commercial growth, while Carbondyne manages platform access and execution logistics behind the scenes.

DSP-Agnostic by Design

Carbondyne’s infrastructure is DSP-agnostic, ensuring flexibility and future-proofing.

- No platform lock-in

- Compatible with major DSP environments

- Designed to support multiple DSPs across regions

- Adaptable to client, market, or campaign-specific requirements

This approach allows agencies to scale programmatic activity without restructuring internal teams or technology stacks.

Commercial & Operational Advantages

Carbondyne’s DSP enablement model is designed to improve both operational efficiency and agency economics.

Key advantages include:

- No minimum spend commitments

- Faster access to premium inventory

- Simplified onboarding for new agencies

- Ability to bundle DSP access with PMP and CTV offerings

- Additional commercial rebates provided by Carbondyne on campaign execution, over and above any DSP-level incentives

This structure allows agencies to remain competitive while maintaining pricing flexibility for their clients.

Get Started with Carbondyne infrastructure

If you would like to explore how Carbondyne’s programmatic infrastructure can support your OEM, CTV, or curated PMP initiatives, we invite you to schedule a short introductory discussion. Our team will review your objectives and outline how access, curation, and execution can be structured for your agency or brand.